What Is The Medical Expense Deduction For 2025

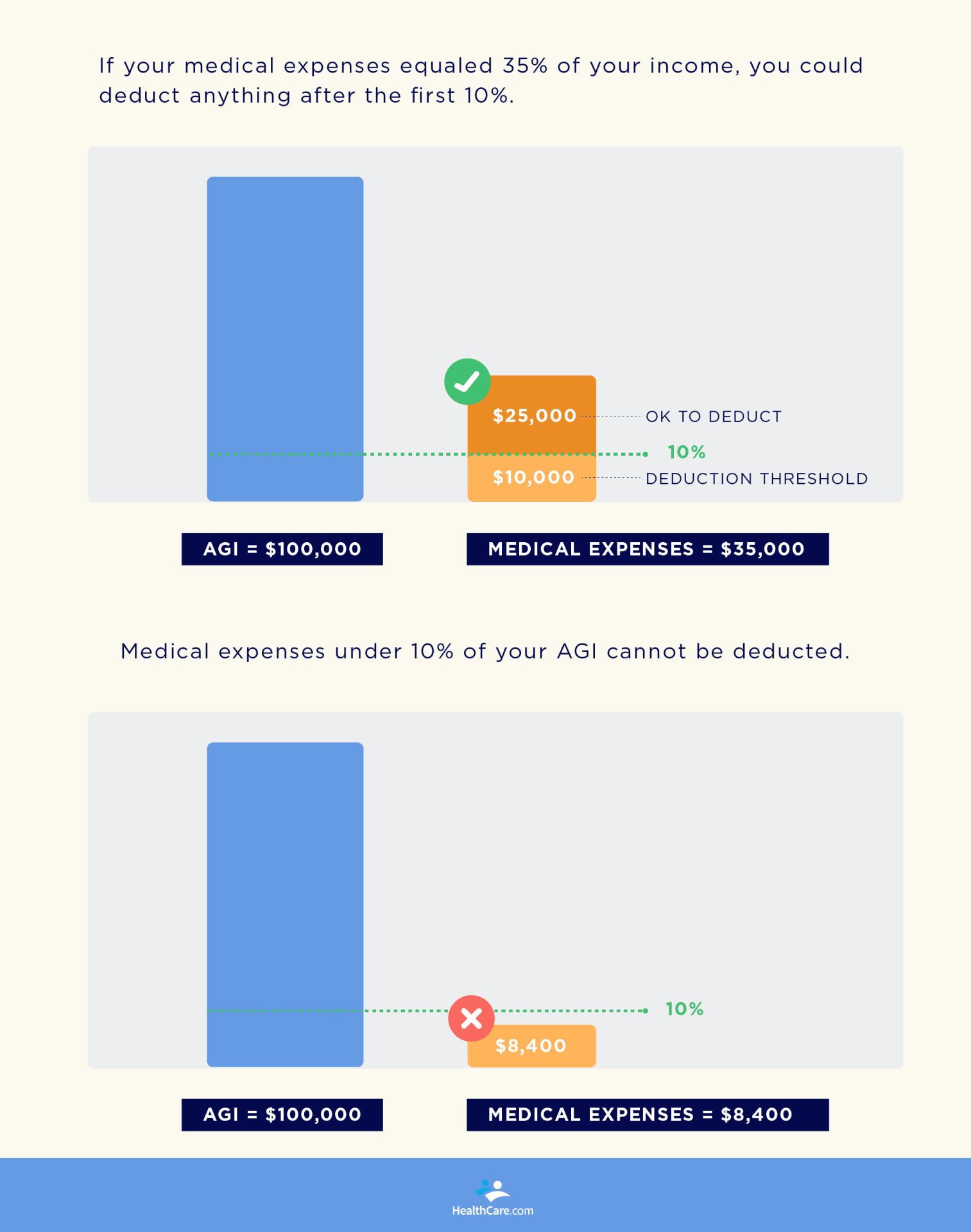

What Is The Medical Expense Deduction For 2025. The good news is that the irs allows taxpayers to deduct the qualified unreimbursed medical care expenses for the year that exceeds 7.5% of their agi. For 2025 tax returns filed in 2025, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2025 adjusted gross income.

If your home’s value doesn’t increase, you can include the entire cost in your medical expense deduction. Note, however, that you’ll need to itemize deductions to deduct medical.

If your total itemized deductions were not greater than the standard deduction for your filing status then there is no need for you to amend your tax return.

SNAP Medical Expense Deduction Worksheet Hunger Solutions New York, Certain medical expenses require a certification. If your home’s value doesn’t increase, you can include the entire cost in your medical expense deduction.

What Medical Expenses Can I Deduct? A Look at Tax Deductions, If you have medical expenses that exceed 7.5% of your adjusted gross. You can claim only eligible.

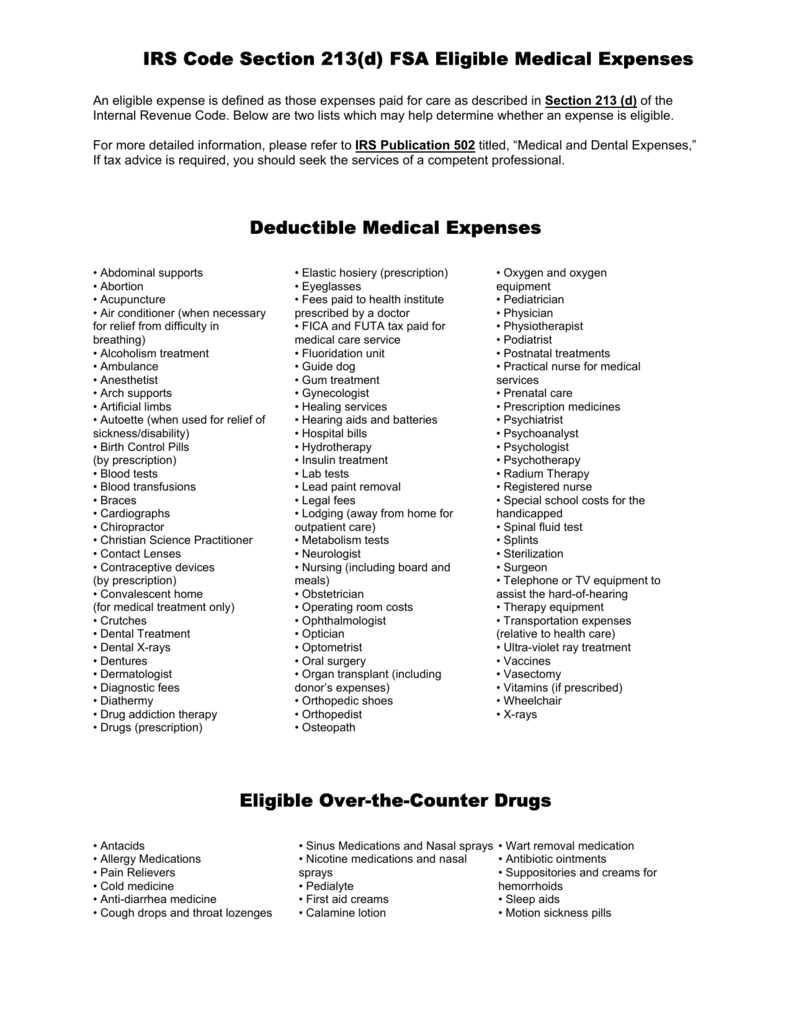

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible, 22 medical expenses tax deductions in canada to claim in 2025. Tax deductions for medical expenses can provide relief for taxpayers.

Medical expenses deduction How much can you actually deduct? Marca, When completing the ‘trading’ pages of the partnership tax return for 2025 to 2025 the following combined entries are. To help you understand which medical and dental expenses may qualify for deductions on your 2025 taxes, here’s a.

Section 80D Guide Tax Deductions for Health Insurance & Medical, For example, if you itemize, your agi is $100,000. If your total itemized deductions were not greater than the standard deduction for your filing status then there is no need for you to amend your tax return.

How Does the Medical Expense Deduction Work? Finance Tips Business, If your total itemized deductions were not greater than the standard deduction for your filing status then there is no need for you to amend your tax return. Credits or deductions related to medical expenses.

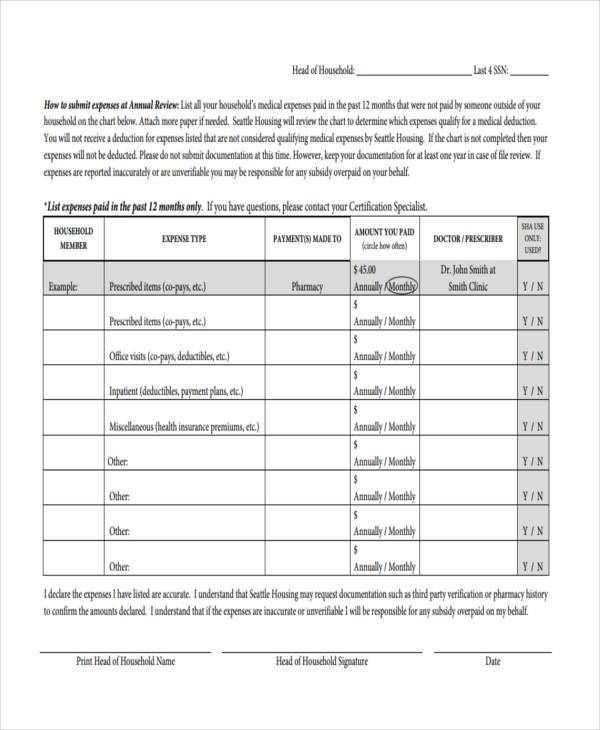

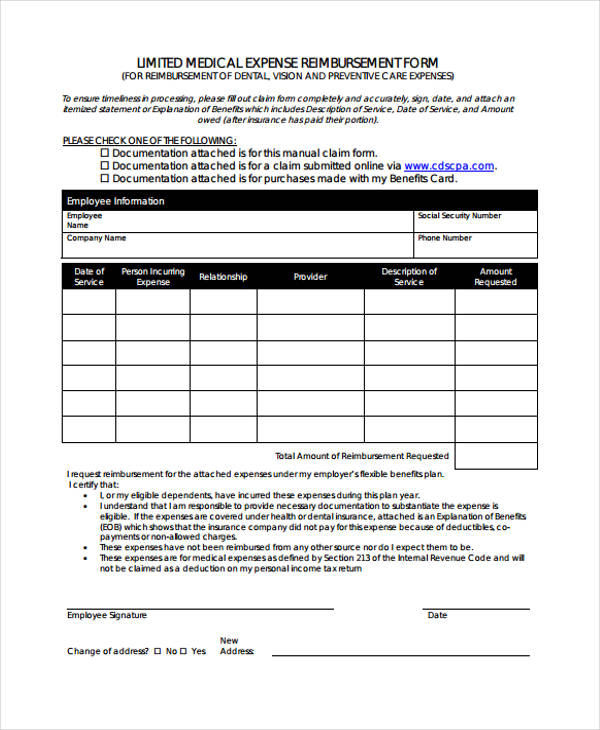

FREE 8+ Sample Medical Expense Forms in PDF MS Word, It discusses what expenses, and whose expenses, you can and can't. For example, if you itemize, your agi is $100,000.

FREE 11+ Medical Expense Forms in PDF MS Word, For 2025, the standard deduction is $14,600 for single taxpayers and $29,200 for married couples. 3.2 entries in the 2025 to 2025 partnership tax return.

How to Claim Your Medical Care Expense Deduction ExpressMileage, Which medical expenses are deductible? 22 medical expenses tax deductions in canada to claim in 2025.

Medical Expenses Deduction FF Tax Policy Center, You can claim only eligible. The limit for tax deductions in 2025 is 7.5% off adjusted gross income and it is very crucial to examine all the medical expenditures and evaluate them accurately.

If your total itemized deductions were not greater than the standard deduction for your filing status then there is no need for you to amend your tax return.